Nate Silver at FiveThirtyEight has an interesting post about why Intrade’s futures prices have barely reflected the major upswing in Obama’s polling over the last week. After the GOP convention, when McCain passed Obama in the polls for the first time, bettors priced McCain as high as 54% midday on Sep 13, a really scary number. But when the polls began to move back Obama’s way last week, prices were sluggish to respond, and still have only got Obama at 52, which given the electoral math, is almost certainly undervalued. Most other betting sites currently price Obama above 60%, while 538 itself puts him above 70%. For markets to be this far out of sync is bizarre:

This is the equivalent of the Giants being 3-point favorites at the Bellagio Sportsbook, and 7-point favorites at the Mirage down the block. Those things just don’t happen in efficient, sufficiently liquid markets, because they create arbitrage opportunities: you’d lay $10,000 on the Giants at the Bellagio and $10,000 on their opponents at the Mirage. Any time the Giants win by fewer than 3 points or more than 7 points, you lose nothing, since your two bets cancel out. But any time they win by fewer than 7 points but more than 3, you win both bets, and take home $20,000 (less the casino’s vigorish) for absolutely no risk. Pretty good deal, right? That’s exactly what’s happening with these futures contracts.

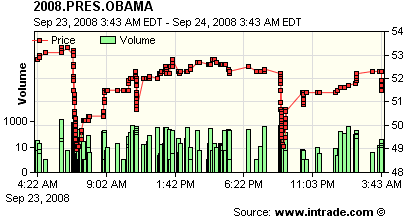

Silver posits that the discrepancy is caused by a rogue trader manipulating prices with strategic trades. If you look at the daily Obama graph, a pattern emerges of high volume spikes driving the price down every few hours, followed by a drift upwards.

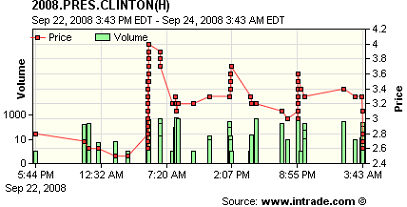

Intrade’s volume isn’t that high, so it wouldn’t take a ridiculous amount of money to play these kinds of games, like it would in the oil market, but you have to wonder what the motive is. Does this gambler just have hundreds of thousands of dollars worth of faith in McCain, or is there insider information at play? Interestingly, Hillary’s prices show a suspiciously similar pattern, only in reverse, with trades at the exact same times, which makes it likely that the same person or persons betting big on McCain are also betting on Hillary at the same times every day.

Whatever this means is anyone’s guess, and I’m sure it’s no cause for alarm, but Silver makes the good point that the authorities should definitely figure out who’s placing these bets, just in case.

I was wondering for the past few days why Obama’s price was so low. This has shaken my faith pretty badly in prediction markets, which I’ve always put some measure of faith in. If all it takes is a bored rich person to completely throw off the stats, they’re worse than useless. On the upside, betting on Obama is a bargain right now, though personally I’d choose to put my money towards donations.

2 comments